Results for the 1st Half-Year 2023

- Results below previous year as expected

- Growth in pharma packaging due to previous year’s acquisitions

- Inflation-related restraint in consumer spending weighs on end markets

- Strong decline in volumes at MM Board & Paper related to market demand and capex

- No recovery in 3Q foreseeable

- Profit and cash protection program initiated

- Adaptation of investment program: Kwidzyn project start postponed to 2024

- Margin improvement – central aim of the initiated measures

Downloads

Group Key Indicators – IFRS

1) The calculation is based on the average of the last 12 months.

2)excl. temporary workers; previous year’s value as of December 31, 2022

3)including impairment of property, plant and equipment and intangible assets

Peter Oswald, MM CEO, comments: “The development of the MM Group in the 1st half-year reflects the continuing weak demand in the cartonboard and paper sector after the record year 2022. As already communicated in mid-June, the significant decline in results is mainly attributable to the weak volume development in the division MM Board & Paper. In contrast, the division MM Packaging was able to record an overall positive performance with the successful integration of last year’s acquisitions in the resilient pharmaceutical packaging sector and factoring in one-off restructuring costs.”

The historically unusual decline in volumes on the European cartonboard market was higher than expected, mainly as a result of the restraint in consumer spending due to inflation as well as reduction of high inventories at customers. In addition, MM recorded considerable capex-related downtime at the Frohnleiten and Neuss board mills in the 1st half-year. Together with the annual maintenance downtime at the Kwidzyn pulp mill, this led to a significant decline in volumes and results in the MM Board & Paper division.

Due to the weak overall economy and sluggish private consumption, there are currently no signs of an improvement in demand. As a result, substantial machine downtime will again be necessary at Board & Paper in the 3rd quarter, aligning production with market demand. Taking this into account, a recovery of results is not yet predictable. In response, a profit and cash protection program has been initiated aiming at comprehensive cost savings, optimizing working capital and reducing new capital expenditures.

“Securing long-term value creation, resilience, and growth in sustainable and innovative packaging for consumer goods is at the core of our business model. Through strengthening our competitiveness and quality leadership during our recent transformation as well as strategic investments in a competitive asset base and product portfolio, the MM Group is very well positioned to benefit from a promising long-term perspective.”, underlines Oswald.

Income statement

The Group’s consolidated sales of EUR 2,181.4 million were slightly below the previous year’s figure (1st half of 2022: EUR 2,218.5 million). A primarily volume-related decline in the division MM Board & Paper was offset by an acquisition- and price-related increase in the division MM Packaging.

Operating profit decreased by EUR 181.0 million from EUR 285.0 million to EUR 104.0 million. This decline primarily results from extensive market- and capex-related downtime at MM Board & Paper. The Group’s operating margin was therefore at 4.8 % (1st half of 2022: 12.8 %).

Financial income amounted to EUR 3.7 million (1st half of 2022: EUR 2.3 million). The increase in financial expenses from EUR -15.6 million to EUR -24.7 million is mainly due to higher interest expenses for Schuldscheindarlehen and financing of accomplished acquisitions and organic growth projects. “Other financial result – net” changed from EUR -1.6 million to EUR -5.9 million, in particular owing to currency translation.

At EUR 77.2 million, profit before tax was also lower than the previous year’s figure (1st half of 2022: EUR 270.2 million). Income tax expense amounted to EUR 13.9 million after EUR 64.4 million in the 1st half of the previous year, resulting in an effective Group tax rate of 17.9 % (1st half of 2022: 23.8 %).

Profit for the period decreased from EUR 205.8 million to EUR 63.3 million.

Development in the 2nd quarter

Outlook

Due to the weak overall economy and the continuing restraint in consumer spending, no recovery in demand is expected in our end markets in the coming months. While several input prices have fallen there has recently been a slight increase in recovered paper prices. As in the past few months, significant machine downtime will be necessary in the 3rd quarter to align production with market demand.

This particularly affects the MM Board & Paper division, where a modernization downtime was planned for the 3rd quarter in the Slovenian board mill Kolicevo, however, with the timing yet to be determined due to recent floods. At MM Packaging we continue to see reduced order activity mainly in the food sector.

MM responses to this development with a profit and cash protection program, which includes comprehensive cost savings, optimizing working capital and reducing new capital expenditures. The focus is to swiftly restore margins, reduce net debt and enhance our competitiveness. For the 3rd quarter 2023, however, the profit situation is expected to remain tight.

MM Board & Paper

1)including interdivisional sales

In the European cartonboard and paper industry, the market environment has changed drastically after the record year 2022. In addition to the reduction of high inventories in the supply chain, the inflation-related change in purchasing behavior for consumer goods led to a volume decline of around 20 % in the European cartonboard market. This historically unusual change was also exacerbated by the loss of the Russian market as well as weak and competitive overseas markets.

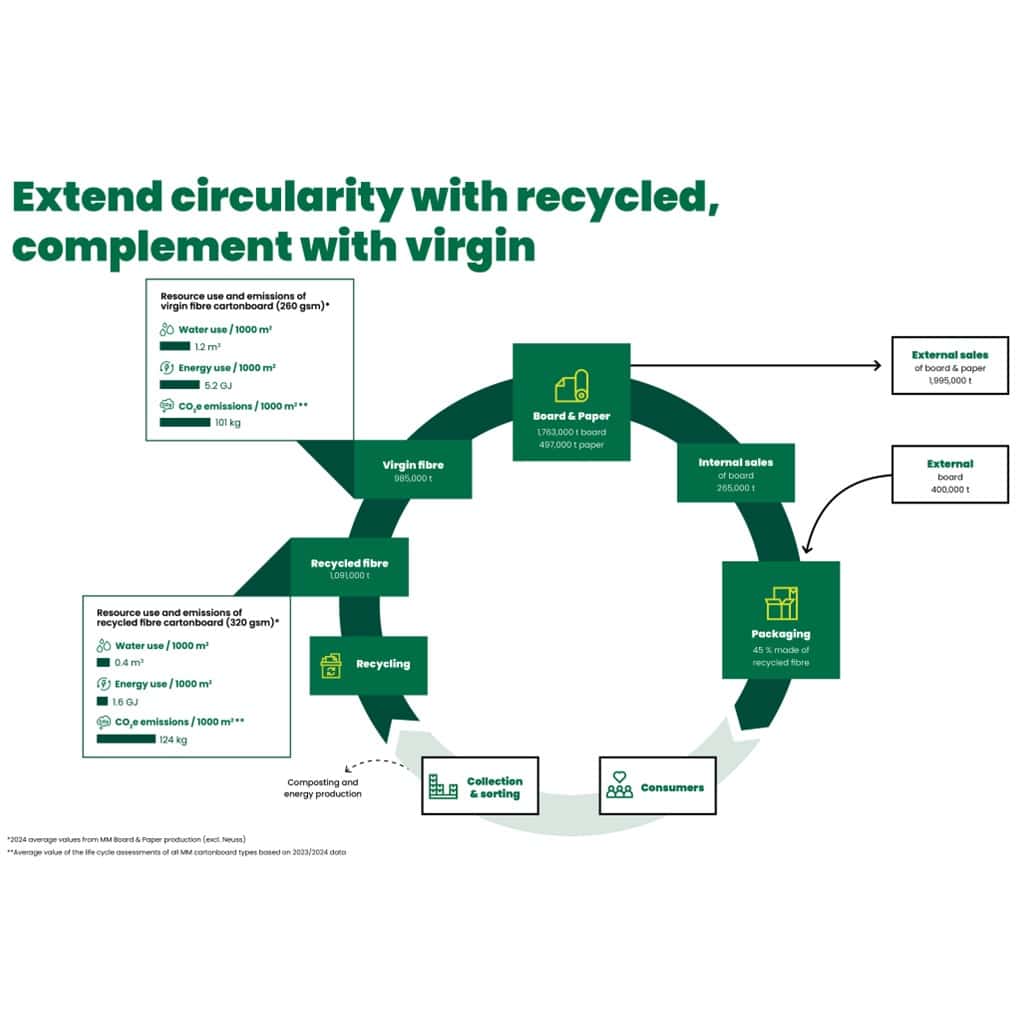

As a consequence, MM recorded market-related downtime on a so far unprecedented scale, analogous to the industry as a whole. Furthermore, there was planned major capex-related downtime at the Frohnleiten and Neuss board mills, with the latter lasting approximately three months. They are part of a comprehensive program to increase the competitiveness of MM Board & Paper in recycled fiber-based cartonboard through more efficient, sustainable and innovative product solutions and processes.

The sharp decline in volumes was connected with a significant reduction in profit compared with the previous year’s record levels. The division’s average order backlog was 139,000 tonnes after 302,000 tonnes in the 1st half of 2022.

On the procurement markets, some input prices decreased compared with the previous year due to current lower demand (e.g. recovered paper), so that more pressure was built up on sales prices.

Sales at EUR 1,019.3 million were mainly volume-related EUR 362.9 million (-26.3 %) below the comparable figure (1st half of 2022: EUR 1,382.2 million). The operating profit amounted to EUR 17.9 million (1st half of 2022: EUR 201.7 million), the operating margin to 1.8 % (1st half of 2022: 14.6 %).

Both tonnage produced and sold at 957,000 tonnes and 959,000 tonnes, respectively, were no-ticeable below the previous year’s level (1st half of 2022: 1,330,000 tonnes and 1,280,000 tonnes, respectively).

Project start of strategic investment at MM Kwidzyn, Poland, postponed to 2024

On April 26, MM announced the approval of a comprehensive investment project to increase the long-term competitiveness of its largest board and paper mill MM Kwidzyn in Poland. Significant energy and CO2 cost reductions as well as increased pulp integration and the entry into the market for sack kraft paper are to set the mill up for sustainable future success. The implementation of the investment project of around EUR 660 million, which is subject to certain conditions, has been planned for the years 2023 – 2026 with disbursements until 2027. Due to current market conditions, the start of the project has been postponed to 2024.

MM Packaging

1)including interdivisional sales

The European folding carton market also showed an increasing weakening in the 1st half of 2023 against the background of declining consumer purchasing power. The food sector was particularly affected. In addition to the reduction of inventories along the entire supply chain, the decline in retail sales compared to the previous year as well as occasional temporary shifts from cartonboard to cheaper plastic packaging had an impact.

In contrast, our business in the premium sector showed an overall more stable development in the 1st half of the year, whereby order intake has also been declining here for some months in selected markets. The significant growth of MM Packaging compared to the previous year resulted particularly from the inclusion of the previous year’s acquisitions in the pharmaceutical packaging area, which was contrasted by the sale of the Russian sites.

A major focus was therefore on the integration of the 21 ex-Essentra Packaging sites with im-provements in quality, service and productivity, which have been overall successfully implemented to date. This once again confirms that the company is on the right track with the turnaround and the leveraging of synergies. Necessary adjustments in the existing business relating to a packaging site in Germany resulted in one-off expenses of around EUR 16 million in the 1st quarter.

At EUR 1,263.2 million, sales were acquisition- and price-related 32.0 % above the previous year’s figure of EUR 957.3 million. Operating profit of EUR 86.1 million (1st half of 2022: EUR 83.3 million) was in particular influenced by the aforementioned one-off expenses, but also by the divestment of the profitable business in Russia. The operating margin amounted to 6.8 % (1st half of 2022: 8.7 %).

Produced volume increased acquisition-related by 8.4 % to 2,073 million m2 (1st half of 2022: 1,913 million m2).

Quarterly Overview

Forthcoming Results:

November 7, 2023 Results for the first three quarters of 2023

Investors

Get in contact with Investor Relations

We look forward to your message and always seek a prompt answer.

IR News

Publication Mailing

To keep you regularly updated about company reports and press releases, we offer the subscription to our publication mailing for shareholders and stakeholders.